ic! berlin Group

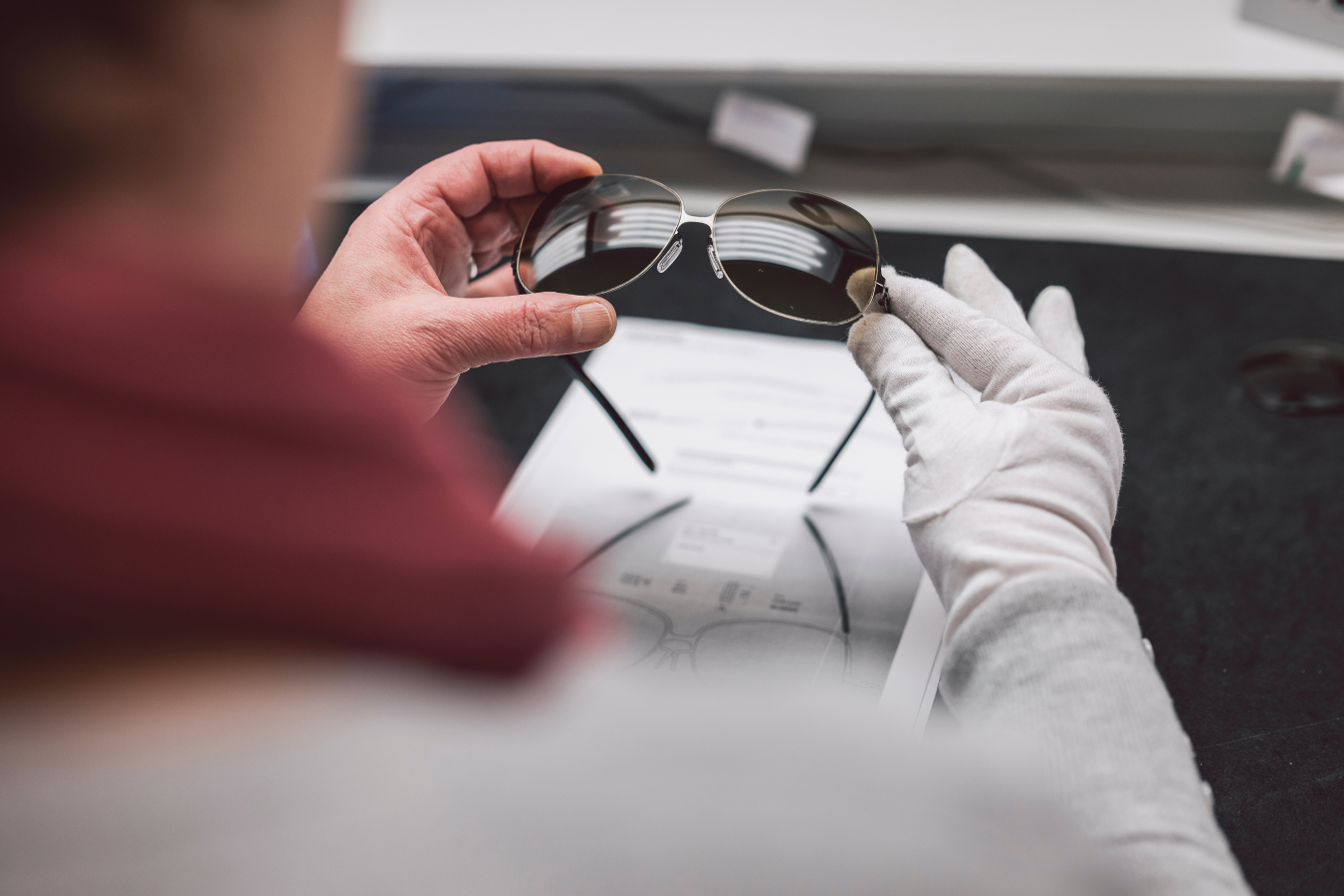

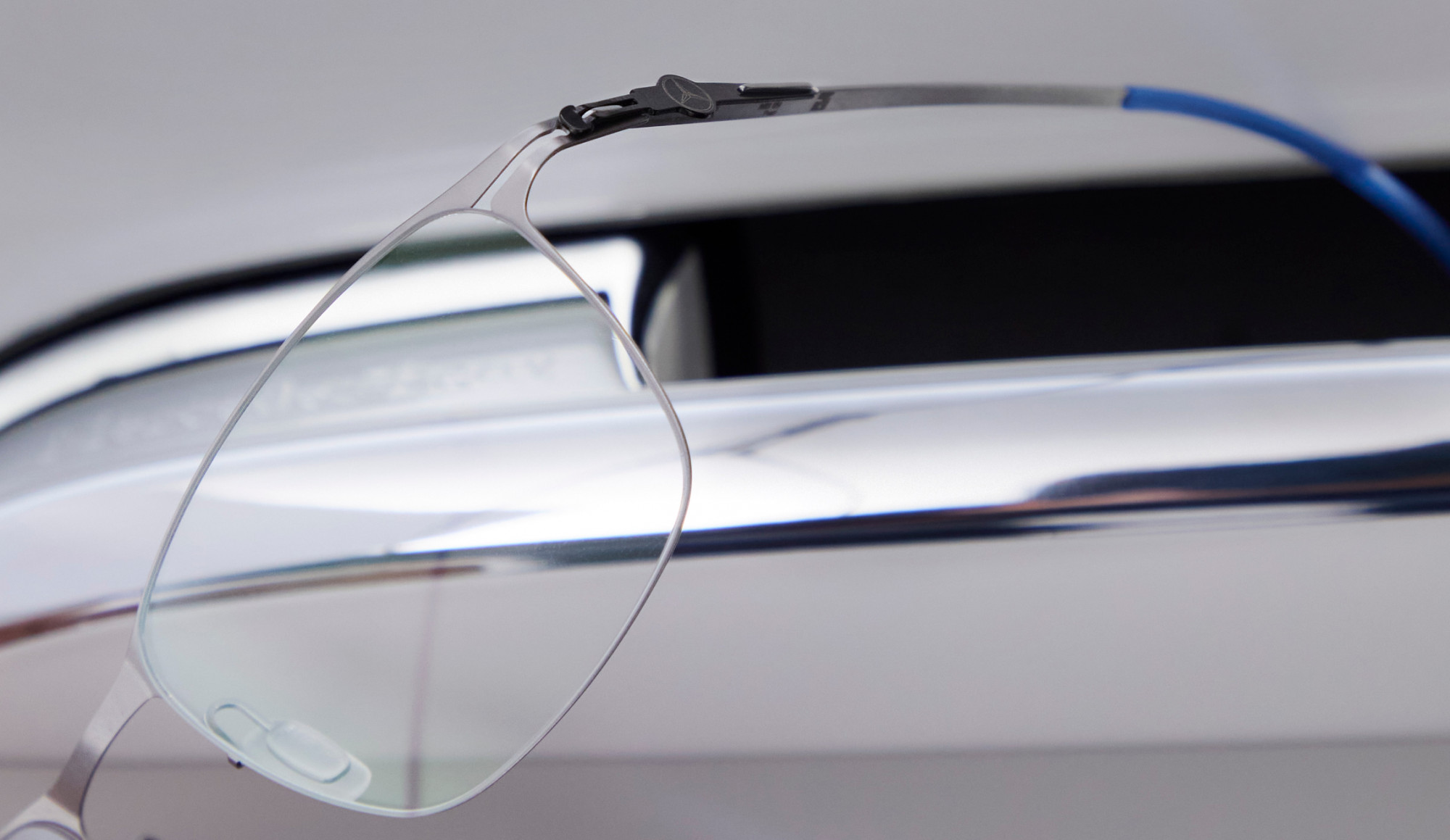

ic! berlin has become one of the most well-known German eyewear brands in the premium price segment. As a pioneer in extra-light metal eyewear, ic! berlin sunglasses and corrective eyewear are known for their design, high manufacturing quality and outstanding comfort, as well as patented screwless joints. In addition to metal glasses, its product portfolio also includes acetate frames – manufactured in-house in Berlin. ic! berlin takes care of development, design, manufacturing and sales to leading opticians and distributors, and has its own flagship store.

Consumer

+ Lifestyle Goods

Sector

MBO

Reason for investment

Premium

Eyewear

Industry

since

2017

Investment period

Investment procedure

ic! berlin is the first investment of the two PREMIUM SME funds launched with Bankhaus Lampe. As the majority shareholder, PREMIUM works closely with the management, which was also involved in the transaction. Management, the advisory board and PREMIUM defined the strategic priorities at the start of the investment. There is a particular focus on enhancing brand recognition and driving international sales.

Strategic and operational measures

Expansion of the sales team, hiring a new CSO/CMO

Joint venture with a leading Chinese luxury eyewear retail chain

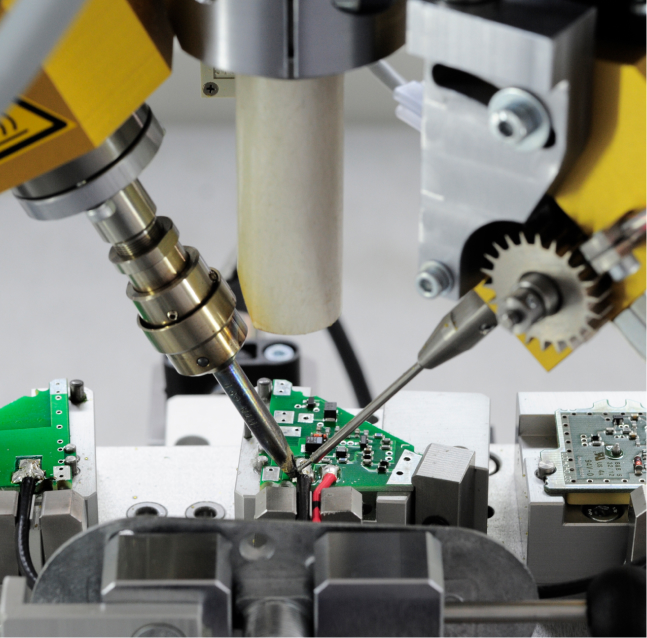

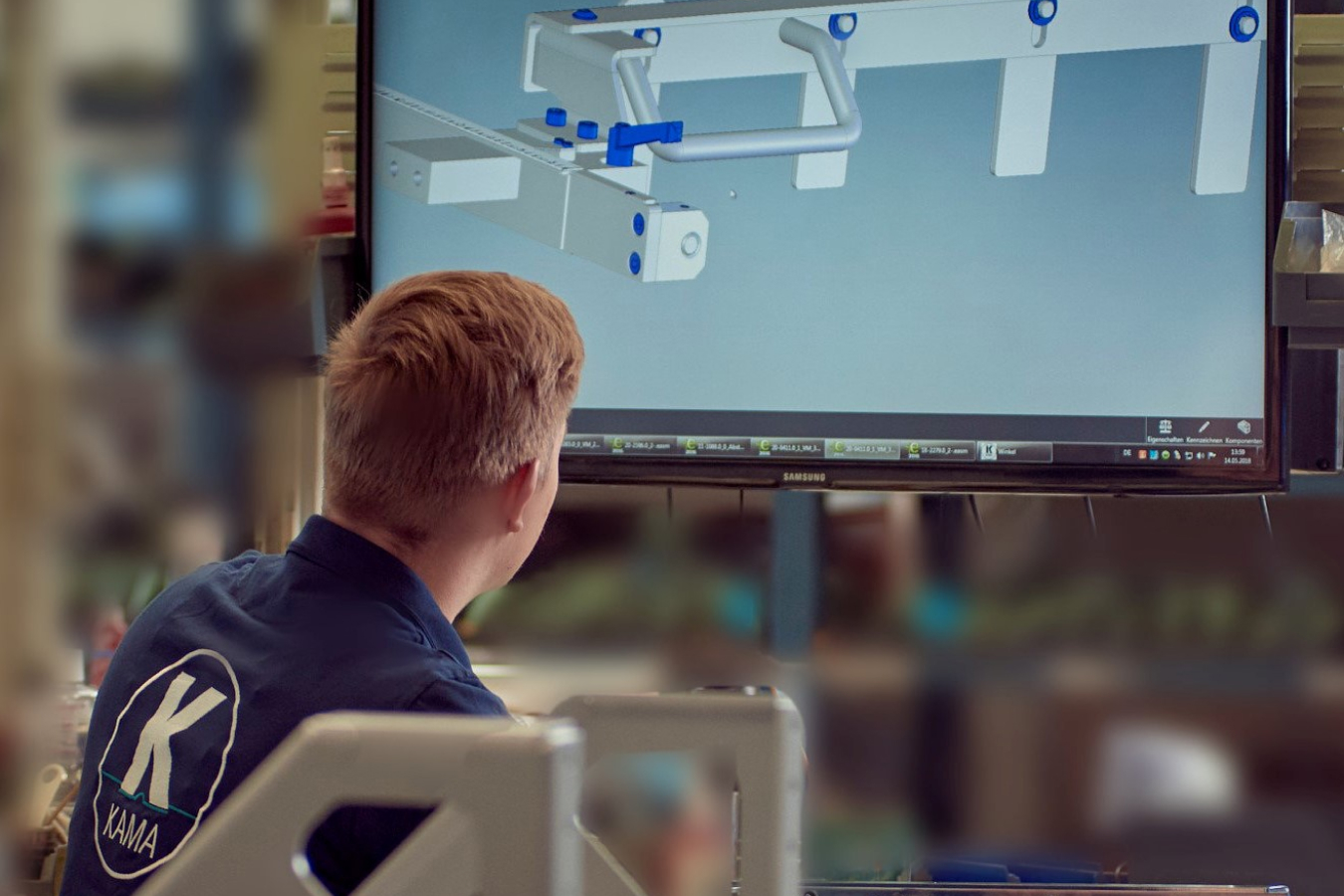

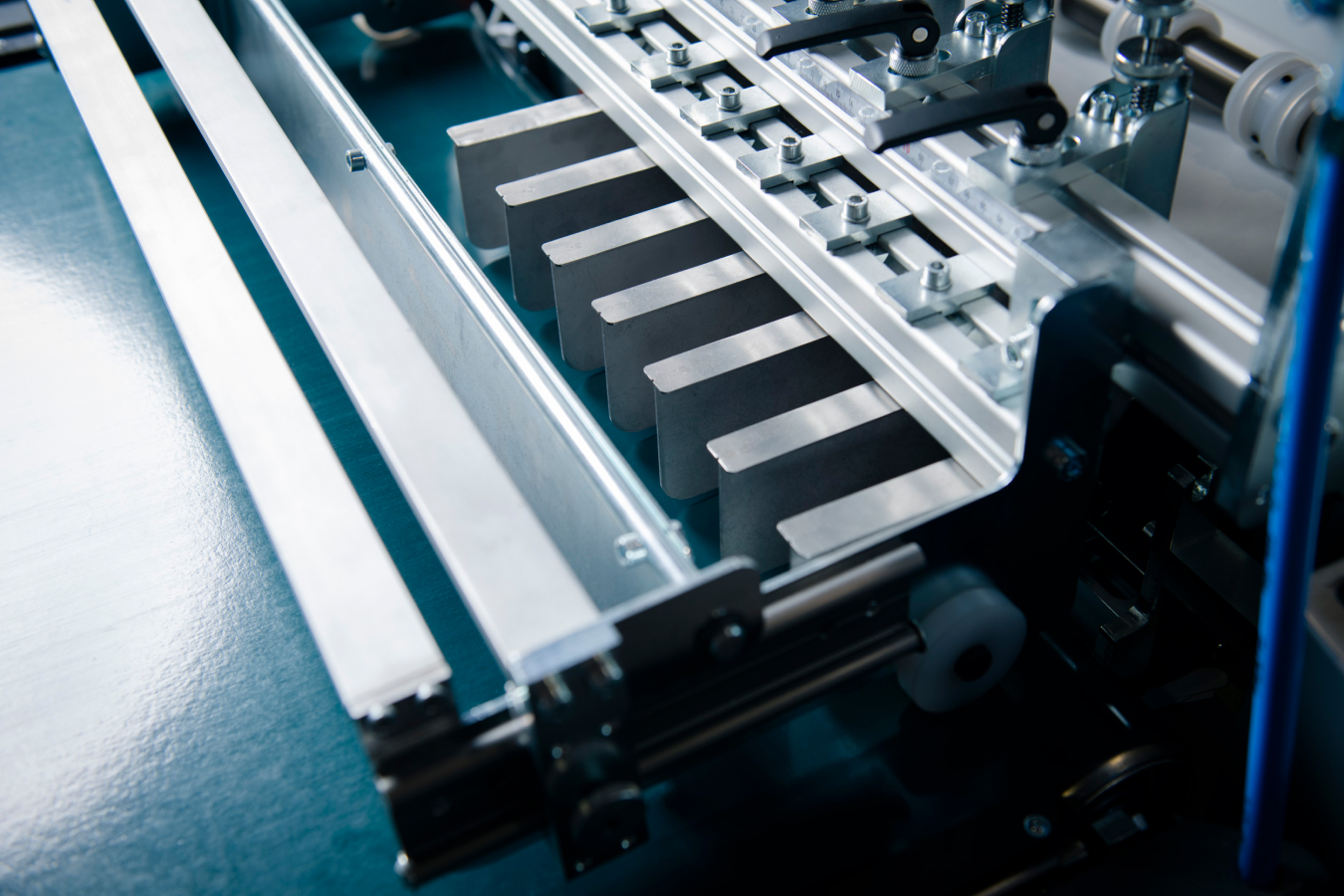

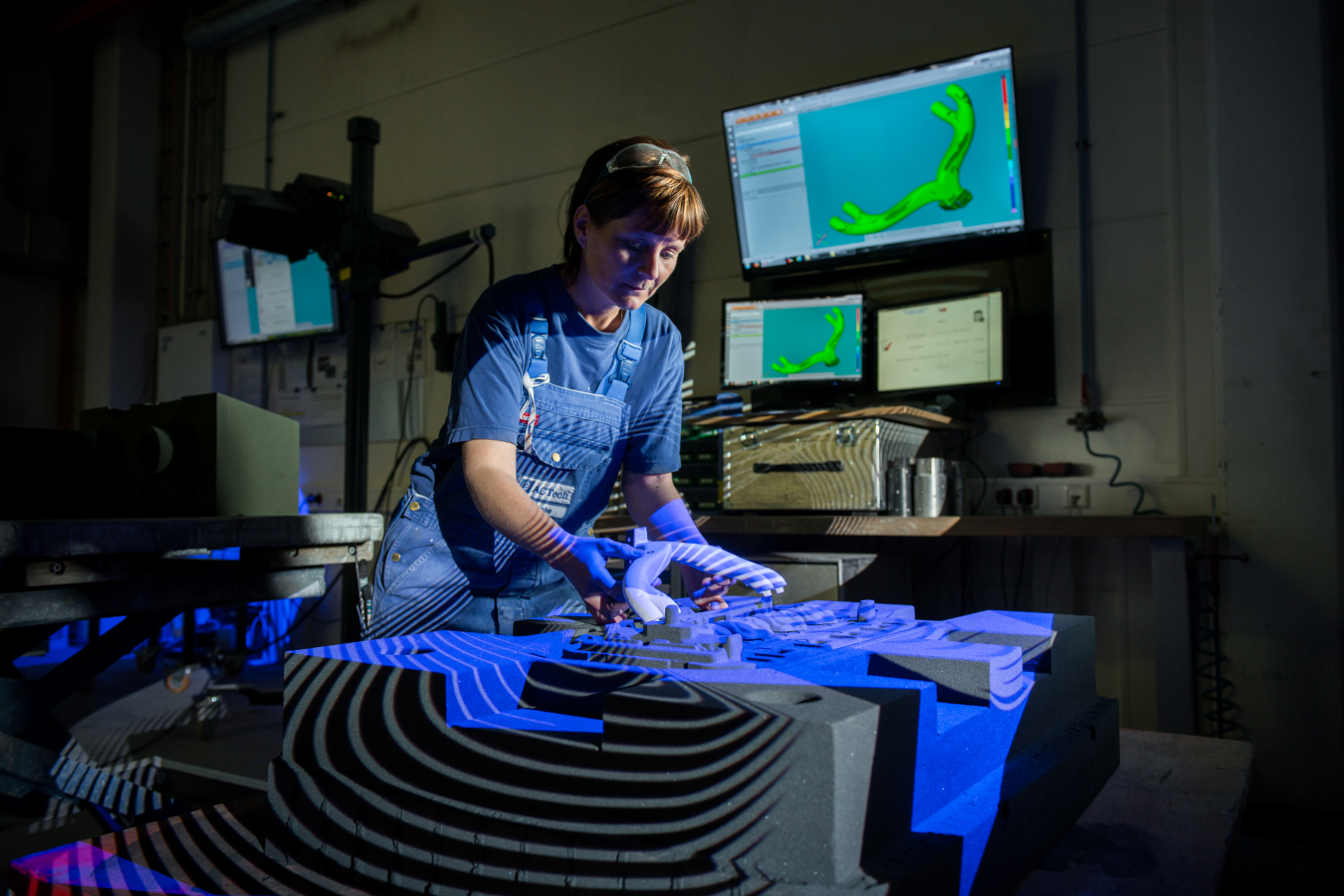

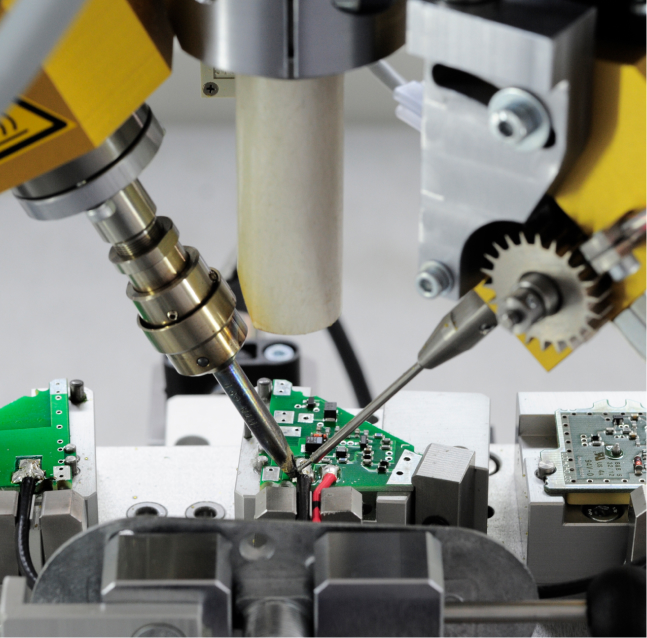

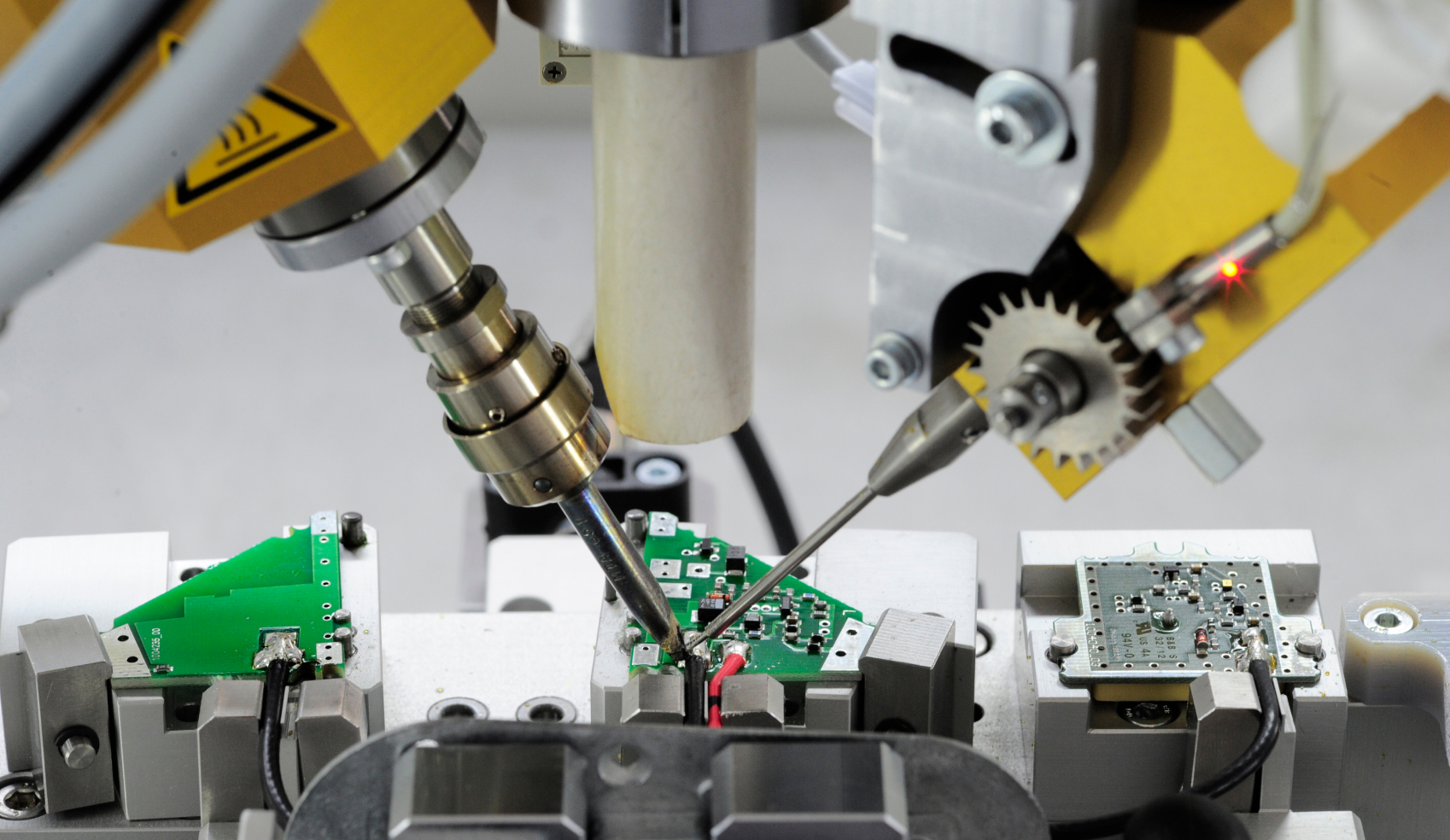

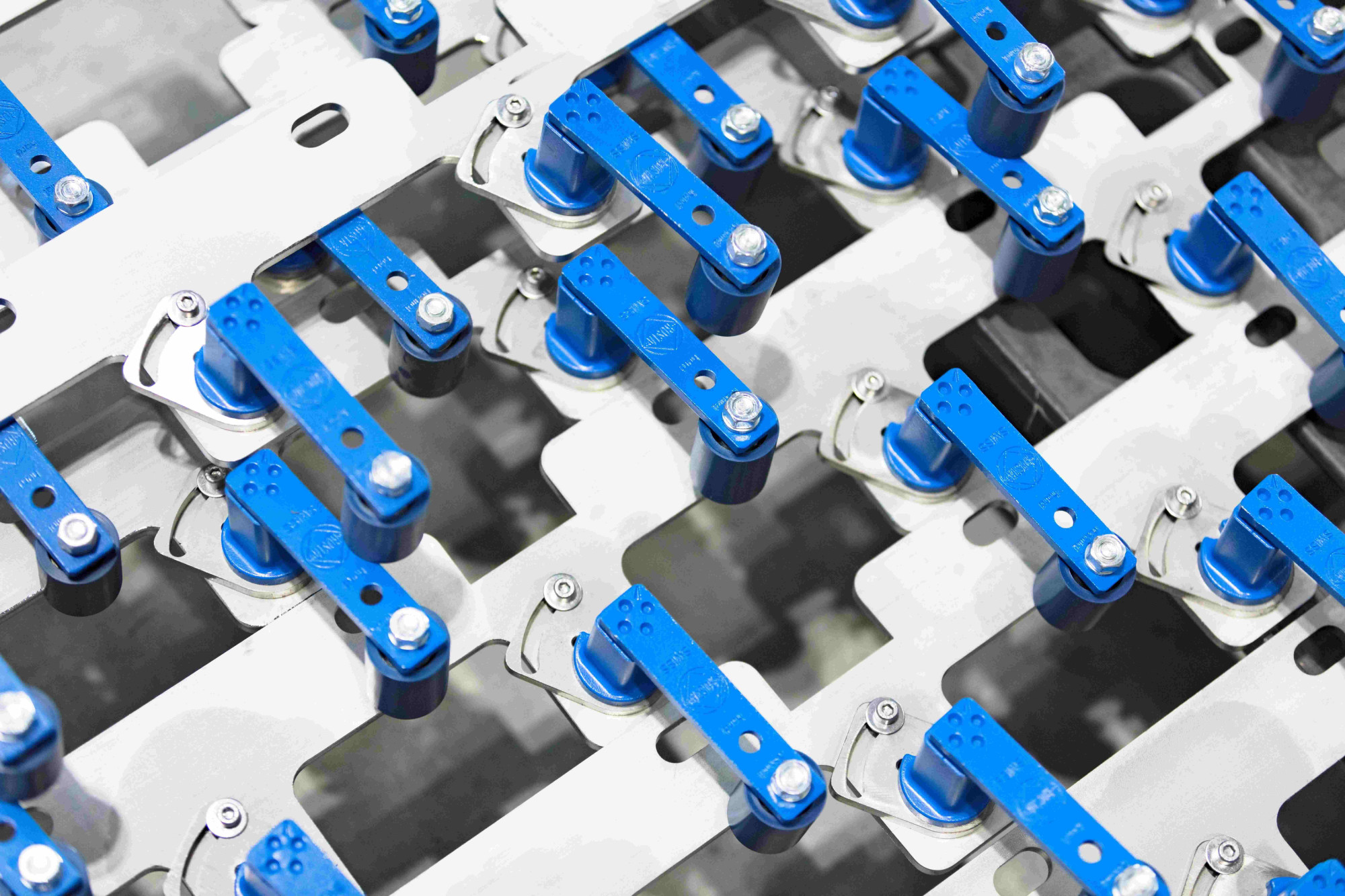

Introduction of LEAN processes

Milestones in the company’s development

Introduction to the Chinese market

Unbeatable delivery times thanks to significant reduction in production lead times

„By rethinking and implementing digital structures and processes, we have been able to reduce production time by 50%. In this way, ic! berlin combines manufacturing quality and Industry 4.0.“

Do you want to know more?

Dr. Wolfgang Rebstock

Advisory board chair and operating partner